2025-Q2 Polkadot Treasury Report

Introduction

-8c2fdf430b4a24f2afce49aca9dee68d.png)

This is the 2025-Q2 Polkadot Treasury Report. It is part of the Treasury Report series and is an important tool for informing Polkadot stakeholders.

Key Insights

- The Balance Sheet shows 106m USD (31.1m DOT).

- On the asset side…

- 76m USD (22.2m DOT) are free for spending. 4m USD of the cash reserves are available as stablecoins, with an additional 5.7m DOT (19.4m USD) allocated to automated stablecoin acquisition.

- 21.8m USD (6.4m DOT) are earmarked for strategic initiatives such as marketing, DeFi tooling, gaming, BD, etc.

- 8.5m USD (2.5m DOT) are deployed into DeFi market operations.

- 2.7m USD (790k DOT) in liabilities are payable until the end of the year.

- On the asset side…

- Expenses

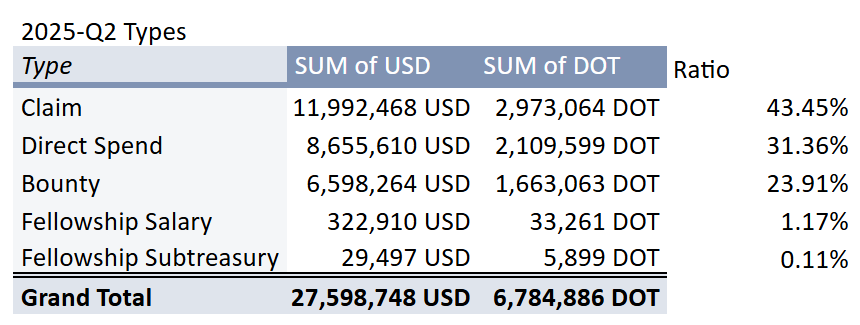

- The Treasury has spent 27.6m USD (6.8m DOT) in 2025-Q2. The operating loss before inflation and burn is 6.7m DOT. Accounting for inflation and burn, the net loss is 2.7m DOT.

- The top 3 spending categories were Economy (9.1m USD), Development (5.9m USD), and Outreach (4.5m USD)

- Departments (Bounties and Collectives)

- 25% (7m USD, 1.7m DOT) of the spending happened via departments

- Stablecoins: 9.7m USD have been acquired in stables. 10.8m USD in stables have been spent.

- OpenGov is deploying capital into the economy: 8.5m USD are provided as liquidity into 4 different DeFi protocols

- Polkadot has stable reserves. Thanks to the recently changed inflation model, the Treasury’s long-term perspective has become very stable.

About this Report

The Polkadot DAO manages millions of USD in assets. As such, it follows accounting best practices and pioneers them for the Web3 space. The report comes with a balance sheet and income statement. The balance sheet will give a complete overview of all active accounts the Treasury manages and how assets are distributed over its operations. The income statement will break down the categories in which the Treasury spends.

We express our gratitude to the Web3 Foundation for funding this report as part of the OpenGov.Watch initiative. Thanks also to the OpenSquare team for providing an API to fetch spending data via their dotreasury.com project, as well as the Parity data team for providing additional data.

Authors: Alice und Bob, Jeeper

Introduction to the Polkadot Treasury

To help newcomers to Polkadot read this report, we want to begin by offering a few ideas that guide the strategic decision-making of many voters. DAO contributors (”agents”) ensure that the Treasury aligns on strategic initiatives:

- As the guiding strategic principle, Polkadot is committing to the core vision of Web3: Apps that put users back in control of the Internet! Its ecosystem has to be understood as the Polkadot Cloud. A complete stack of Web3 services that allow builders to create powerful and scalable applications and business cases at a fraction of the cost of other ecosystems.

- Polkadot is unstoppable. It sustains itself. Research, development, and operations all focus on delivering secure and resilient core Web3 infrastructure. Bridges, wallets, data services, SDKs, governance and developer tooling, and nodes are all paid for by OpenGov. As a result, the network is not dependent on external organizations.

- Polkadot’s growth thesis is centered on enterprise adoption in key verticals. Its business development and market operations are focused on winning market share in (1) DeFi, RWA & Fintech, (2) Gaming & Entertainment, (3) AI & DePin, (4) Social and Identity, and (5) GovTech. Decentralized business development teams work with investors, accelerators, and ecosystem support teams to help teams onboard and succeed in Polkadot.

- Polkadot is developing its talent pool. The Polkadot Blockchain Academy provides multi-week in-person education to hundreds of founders and developers multiple times per year to provide new projects with qualified personnel. In addition, hackathons around the globe expose thousands of devs each year to Polkadot’s tech stack.

- Polkadot’s outreach effort is unmatched by any other DAO. From content creation in Polkadot-native media brands to distribution, to advertising. From market research to running a decentralized ambassador program and hosting and participating in global events. All of these functions are now operated by the DAO, removing the risks of single points of failure.

- OpenGov is differentiating into specialized departments, scaling up its throughput capacity. Dedicated departments composed of domain experts are forming around key ecosystem functions (e.g. marketing, FinTech integrations, etc) to streamline the processing of related proposals. This reduces the load on the main OpenGov voting tracks and allows stakeholders to focus on high-level decisions.

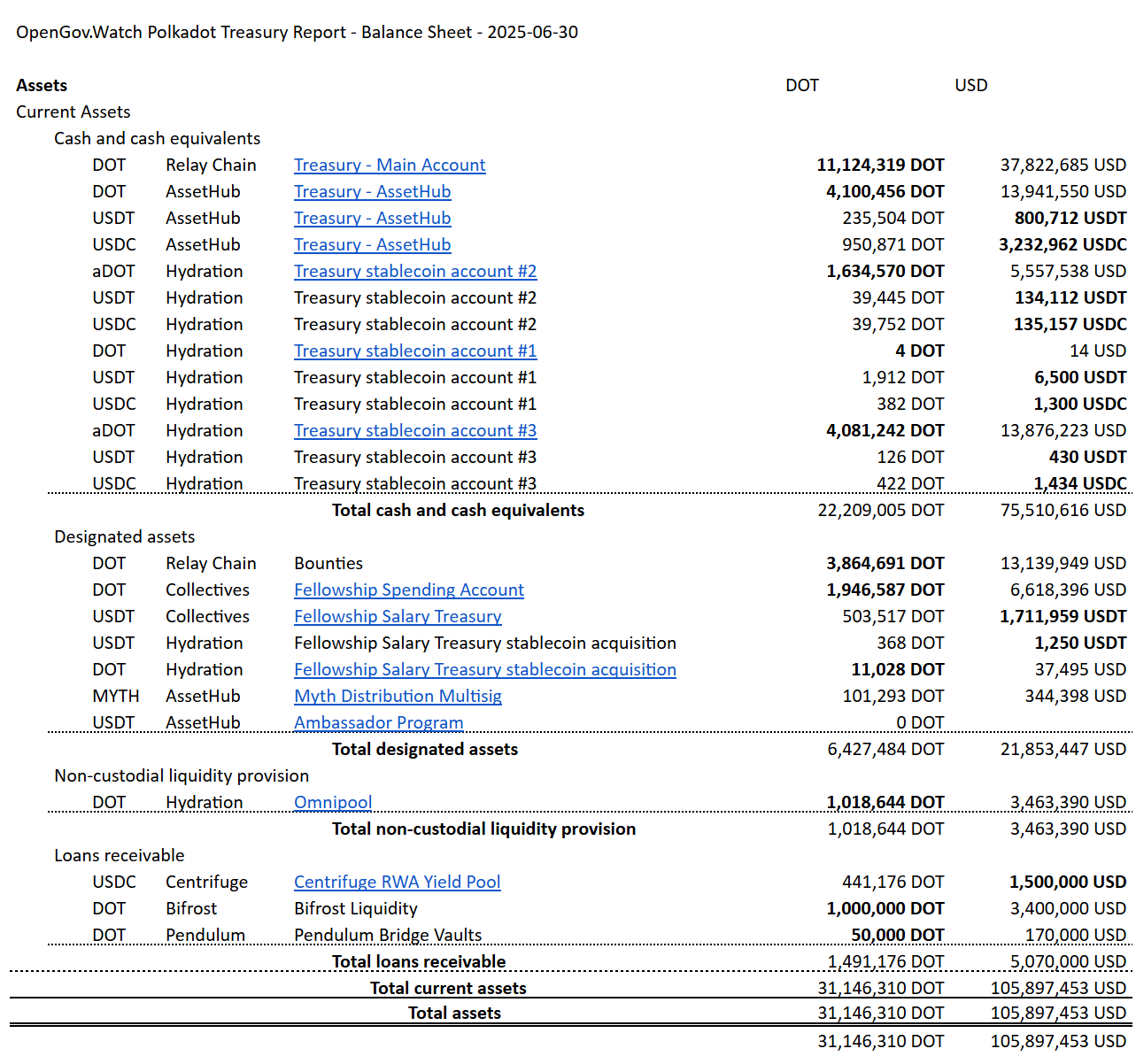

Balance Sheet

The balance of the Polkadot DAO at the end of 2025-Q1 comes out at 33.5m DOT / 135m USD. Accounting for liabilities, there is a surplus of 32.6m DOT / 131m USD.

Assets

You can find the full sheet here.

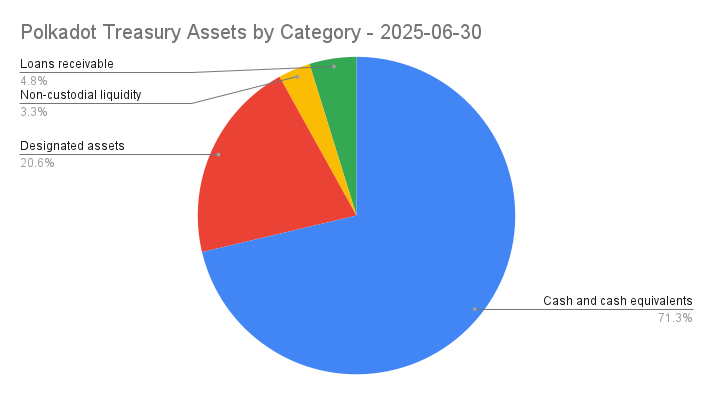

Assets Structure

For the balance sheet, we structure the assets as follows:

- Cash and cash equivalents: 22m DOT / 76m USD

- Designated assets: 6.4m DOT / 22m USD

- Non-custodial liquidity provision: 1m DOT / 3.5m USD

- Loans receivable: 1.5m DOT / 5m USD

Cash and Cash Equivalents (22m DOT / 76m USD)

This category consists of DOT, USDT, and USDC which are immediately or very quickly available for the Treasury's use. Cash is held on the relay chain and AssetHub system chain.

- Relay Chain: 11.1m DOT (38m USD)

- AssetHub:

- 4.1m DOT (14m USD)

- 800k USDT (235k DOT)

- 3.2m USDC (950k DOT)

In addition, two trustless and fully automated stablecoin acquisition campaigns are currently running on the Hydration DeFi chain:

- Stablecoin acquisition campaign #2 still has about 1.6m DOT (5.6m USD) to be swapped within 2025.

- Stablecoin acquisition campaign #3 has 4.1m DOT (13.9m USD) to be swapped until 2026-Q2

Designated Assets (6.4m DOT / 22m USD)

Designated assets are assets that are under the control of OpenGov, but are already earmarked for specific duties, primarily to fund the DAOs executive bodies (bounties and collectives). In addition, Polkadot holds 344k USD in MYTH to be deployed through airdrops to DOT holders.

Bounties

Polkadot has 13.1m USD (3.9m DOT) sitting in bounties, ready to be distributed to teams that perform value-adding activities in the ecosystem. (To learn more about how to request funding, book a free consultation here)

Technical Fellowship

The Polkadot Technical Fellowship is the core maintainer of the runtime. It is funded through the DAO. The Fellowship has two accounts:

- Salary account: 1.7m USDT (503k DOT)

- Spending account: 1.9m DOT (6.6m USD)

MYTH Airdrop

As part of Polkadot’s strategic partnership with Mythical, it acquired MYTH tokens in exchange for 1m DOT. 2.6m USD-equivalent of MYTH were already distributed to DOT holders and service providers. A remaining reserve of 345k USD-equivalent MYTH remains within the MYTH distribution account to be used in the future.

Non-Custodial Liquidity Provision (1m DOT / 3.5m USD)

The Treasury deploys some of its idle capital into the Polkadot economy. 1m DOT (3.5m USD) sits in the Hydration Omnipool as DOT liquidity.

Loans Receivable (1.5m DOT / 5m USD)

These positions are the custodial counterparts of non-custodial liquidity provision.

- 1.5m USDT has been deployed to Centrifuge RWA Yield Pool

- Bifrost has deployed 1m DOT into its liquid staked DOT product

- Pendulum has borrowed 50k DOT for its stablecoin bridge vaults

Assets Portfolio

-c57715692090fd1687ae05f9fb41e5e2.png)

The Treasury holds DOT, aDOT (DOT provided into the Hydration money market), USDT, USDC, and MYTH. The Treasury’s biggest position is in its native asset DOT, with 23m DOT (79m USD) making up 74% of the portfolio. While the Treasury is swapping DOT for stables, it keeps the DOT position in a money market to increase liquidity and earn yield. The aDOT portion of the portfolio makes up 5.7m DOT (19m USD) or 18% overall. The stablecoin portion of the Treasury is 4.6% USDC (4.9m USD) and 2.5% USDT (2.6m USD). MYTH about to be airdropped makes up 0.33% (345k USD).

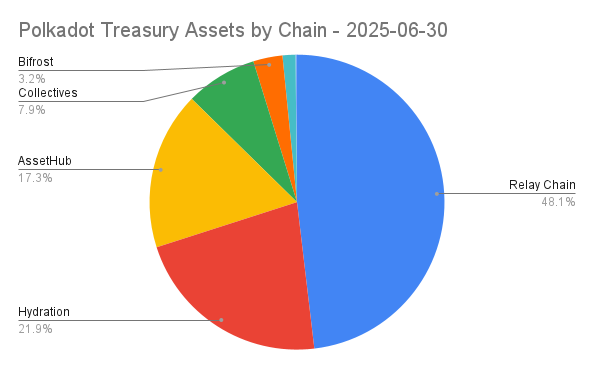

Assets by Chain

Polkadot holds assets on 7 different chains. Parachains are a significant part of the Treasury economy, with 27% of the Treasury’s owned assets being deployed on various DeFi chains like Hydration (23m USD), Bifrost (3.4m USD), Centrifuge (1.5m USD), and Pendulum (170k USD). Polkadot Governance allows decisions to be executed trustlessly across all chains under the Polkadot security umbrella. 73% of the Treasury is held on 3 system chains to be used as free cash and for the various executive bodies.

Liabilities

The Polkadot Treasury has introduced a mechanism for claimable future payments. They represent liabilities. We treat them as “claims payable” in the balance sheet.

- Claims payable in total make up 2.4m USD (720k DOT).

- Wages payable for the Technical Fellowship come out at a maximum of 250k USD (74k DOT) per 28-day cycle.

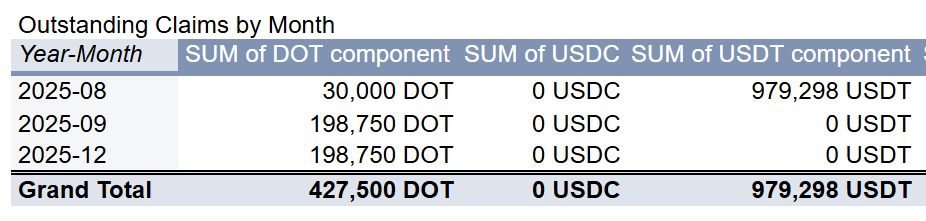

Claims Payable

Claims on future payments have been granted to the amount of 2.7m USD. These consist of 430k DOT and 980k USDT. They last until December 2025.

Income Statement

For the income statement, we use DOT as the primary unit of account, since it is the unit that the main Treasury income - inflation - is based on. For the expenses section, we will additionally provide a USD-denominated table for easier comparison.

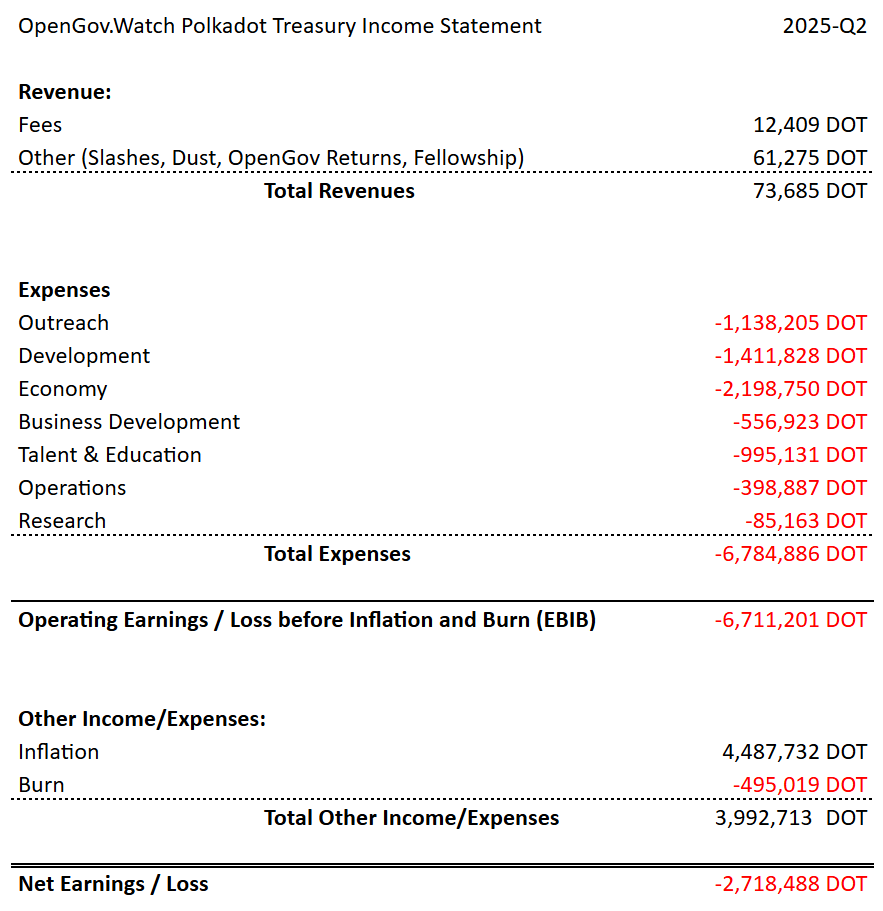

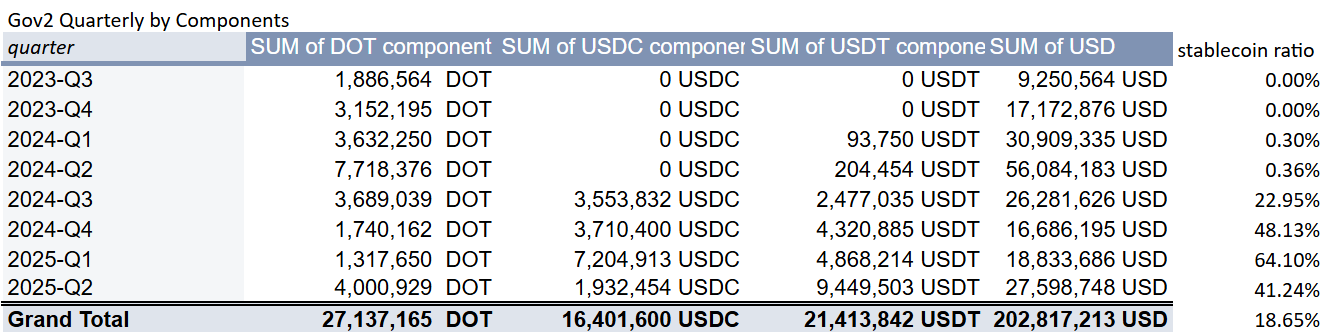

Polkadot has had expenses of 6.7m DOT (28m USD) in the second quarter of 2025. After adding revenue, inflation, and burn, the net loss was 2.7m DOT.

-ad8e009f1914844cf50d89173e394c7c.png)

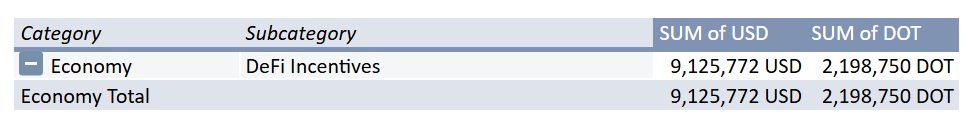

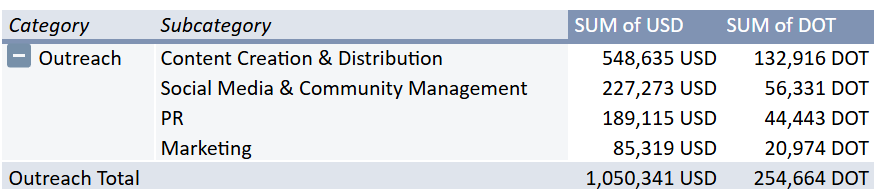

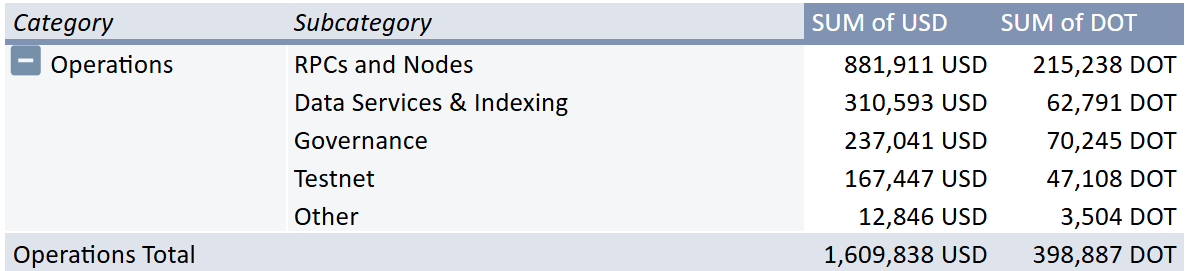

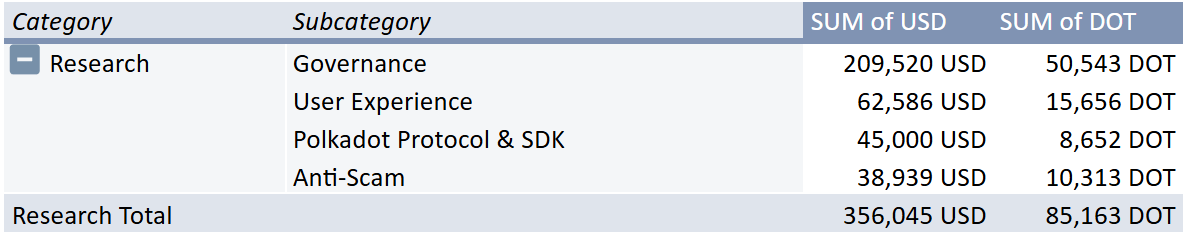

Expenses

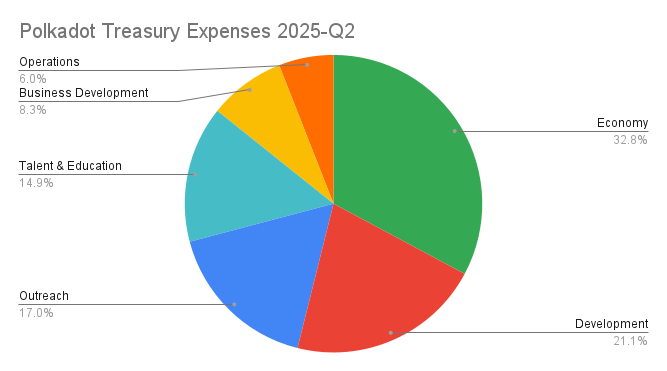

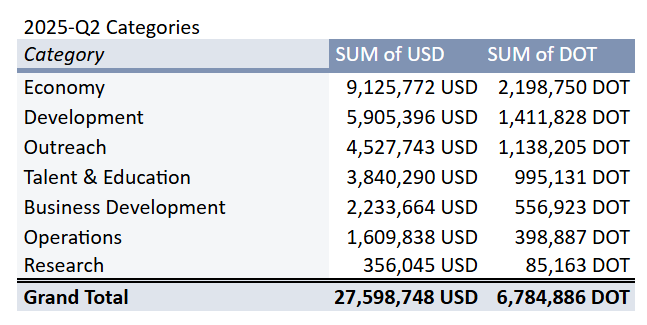

Polkadot spent 27.6m USD (6.8m DOT) in the second quarter of 2025. The biggest position is Economy, leading with 9.1m USD (2.2m DOT). Development of new software came next with 5.9m USD (1.4m DOT). Outreach made up 4.5m USD (1.1m DOT). For Talent & Education, the DAO spent 3.8m USD (1m DOT). Business Development initiatives totaled 2.2m USD (560k DOT). Operations of the network infrastructure cost 1.6m USD (400k DOT). 360k USD (85k DOT) were spent on Research.

We will dig into the details below, but before we do so, let’s look at what categories Polkadot spends money on.

Categories

The categories and subcategories in this report have been selected by our team:

- Research: Security, Governance, Anti-Scam efforts, reports, and analytics, UX & DX

- Development: The Polkadot protocol and its core SDKs, Bridges, Wallets, data services & indexers, SDKs, Governance tooling smart contracts, and various other technologies

- Operations: software, hardware, and service costs incurred to operate the network (RPCs, archive nodes), auxiliary services (explorers, indexers), and legal costs (foundations)

- Outreach (Marketing, BD, Community Development): Marketing (media production, PR, advertising) and community development (conference hosting, conference attendance, local outreach, events, community building, ambassador program)

- Business development: developing verticals like gaming, DeFi integrations, GovTech, music industry solutions, consulting, solution architecture, DevRel

- Talent & Education: education, hackathons, recruiting, and talent incubation through the Polkadot Blockchain Academy

- Economy: Liquidity Incentives to stimulate the economy

Spending Overview

-8c2fdf430b4a24f2afce49aca9dee68d.png)

We see a rise in spending in Q2 that is mainly driven by new DeFi incentives to grow the economy. Business Development and Research were again, like in Q1, below their averages. Outreach was more modest too. Operations was again fairly stable and hitting close to its average. Talent & Education spending made a return after 2 quarters of marginal spends.

Now let’s dive a bit into the individual categories!

Economy

Economy (9.1m USD) consisted of the GIGAHydration (8.3m USD) and DeFi Singularity (830k USD) campaigns to incentivize liquidity on Hydration and bridged chains in the Ethereum ecosystem.

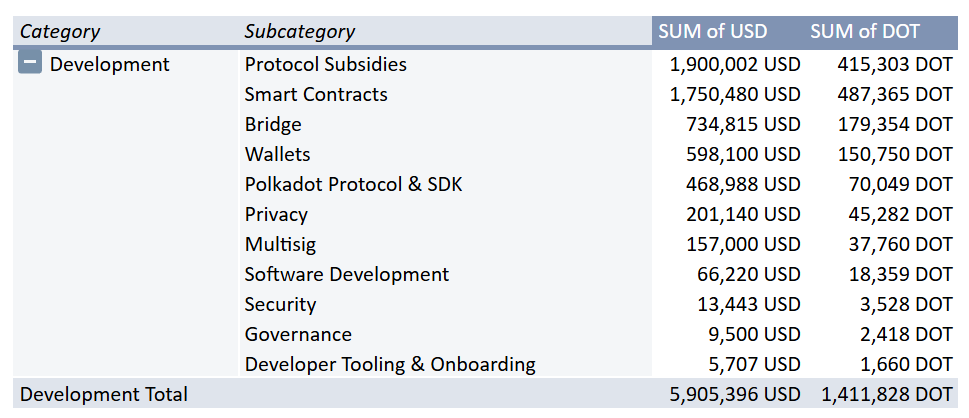

Development

Development (5.9m USD) covers software development specifically for the core Polkadot infrastructure and tools necessary to operate and interact with the network.

Protocol Subsidies (1.9m USD) covered the next phase of the Eiger Storage system. Smart Contracts (1.8m USD) funding went to OpenZepellin for Polkadot Hub and Cloud support for the full year 2025. In the Bridge (730k USD) subcategory, continued funding went to Snowbridge. Wallets (600k USD) went to Talisman for half a year of support and new features.

Under Polkadot Protocol & SDK (470k USD), we had Fellowship salaries (320k USD), OG Rust Bounty payouts (83k USD), and a payout for the Polkadot Pioneers Prize Bounty (29k USD). Privacy (200k) funding went to the Incognitee TEE-based privacy sidechain. Multisig (160k USD) was funding for Mimir in this quarter.

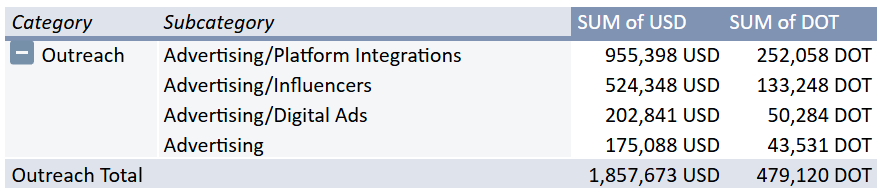

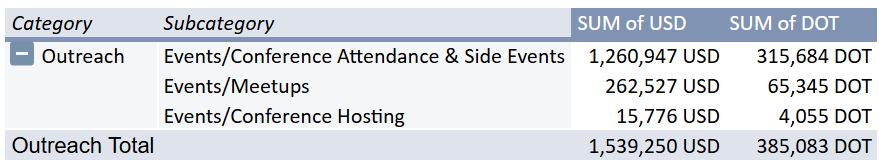

Outreach

4.5m USD was spent on outreach for marketing, events, and community building. The Outreach category is the biggest and most complex. It contains not only subcategories but also sub-subcategories. The most relevant clusters are around marketing and events. We will start by looking at them individually.

The biggest position in Advertising (1.9m USD) was a integration with the Blast e-sports tournament in collaboration with Nova Wallet (920k USD). In the Influencers (520k USD) sub-subcategory, 490k USD were spent on the Kaito campaign and 34k USD on Fracas. Digital advertising made up 200k USD for the Omni paid media campaign. Other ad spends and marketing bounty staff costs add up to 180k USD.

Costs for Events (1.5m USD) are split up between hosting conferences, attending conferences, hosting side events to conferences and funding smaller meetups.

Under Conference Attendance & Side Events (1.3m USD), the biggest positions are The Blockspace Mansion Toronto & Berlin (360k USD), Consensus Toronto (180k USD), The Blockspace Brooklyn (130k USD), ETHLisbon (68k USD), ETHPrague (60k USD), and 20 more events.

For Meetups, 114 meetups were funded with 260k USD. Polkadot also funded the Polimex x Scytale Academy Demo Day for 16k USD to accelerate new projects.

Marketing, PR, Social Media & Community Management, and Content Creation & Distribution in total made up 1.1m USD.

For Content Creation & Distribution (550k USD), Polkaworld (270k USD), The Kusamarian (98k USD), Pala Labs’ coverage of the JAM tour (69k USD), WebZero’s coverage of the hackerhouses (49k USD) and a few other creators were funded for native Polkadot media. Social Media & Content Management (230k USD) consisted of an Airlyft campaign (81k USD), the Social Media Editorial Board (40k USD) and salaries.

In the PR category, the APAC marketing agency Serotonin was funded with 183k USD. Marketing covered some additional positions for 85k USD, notably some co-marketing support for Acurast (27k USD) and Hyperbridge (10k USD).

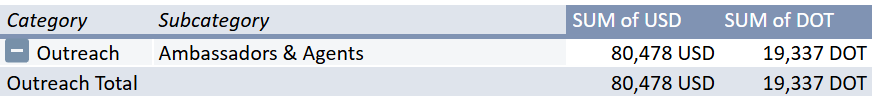

Other items in the Outreach category include Ambassadors & Agents (80k USD), where next to a bunch of individual tips there is a notable funding of Polkadot’s representation in the Texas Blockchain Council.

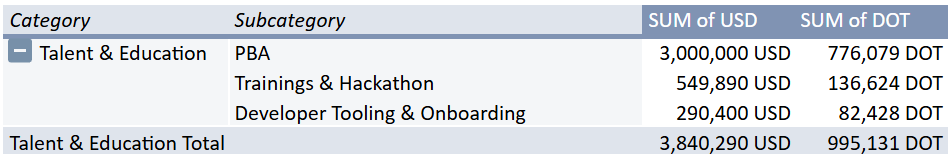

Talent & Education

Talent & Education (3.8m USD) covers costs associated with growing the Polkadot talent pool.

The Polkadot Blockchain Academy was funded with 3m USD for campus cohort 7, The JAM course launch, a university pilot, PBA-X, and the Alumni program. In Hackathons (550k USD), EasyA (395k USD), Encode Club (130k USD), Goa 2025 (26k USD) got funded. In Developer Tooling & Onboarding, OpenGuild was granted 290k USD to accelerate Polkadot Builder Activation in SEA & Broader Asia

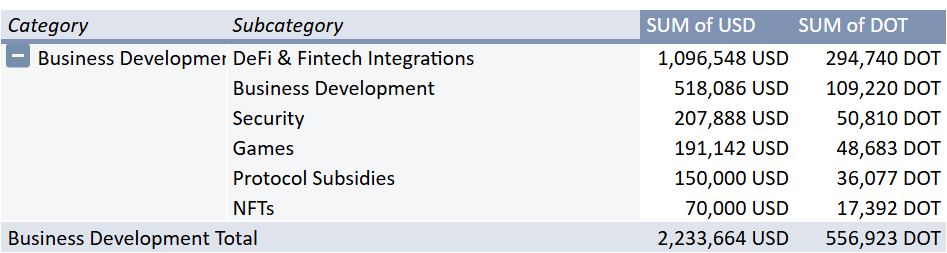

Business Development

Business Development (2.2m USD) efforts focused on market penetration of several verticals, as well as funding niche-specific tech and experiments.

DeFi & Fintech Integrations (1.1m USD) was leading the category this time, with Merkle Science (330k USD) receiving a grant to provide market indexes to the upcoming Polkadot Hub. Other products being integrated were DIA (110k USD), Uphold (80k USD), Nima Labs (78k USD), and Ripio (69k USD) as well as several others.

Under Business Development (520k USD), three different BD teams have been funded: PoKe (290k USD), Spanish BD team (140k USD), and PolkaBiz (83k USD). Under Security (208k USD), three audits were funded: frontier-srlabs (96k USD), dotpal-cg-microsr25519 (40k USD), and coinfabrik-scout (17k USD).

In Games (190k USD), the SAGE engine received 80k USD and indie game EVRLOOT was supported with 68k USD. As a Protocol Subsidy, Robonomics was supported with 150k USD for its kick-start campaign for RISC-V smart home devices, and DotMemo received 70k USD in the NFTs category.

Operations

Operations (1.6m USD) covers software and hardware essential to operate the network.

RPCs were funded with 880k USD. Data Service SQD received 310k USD. Under Governance (237k USD) we see JUST receiving 235k for their OpenGov contributions and Anaelle receiving a 2k USD tip. The Testnet Paseo cost 170k USD.

Research

Research (360k USD) funds projects that are experimental, research-driven, or surface new data.

The Polkadot Ecology Research Institute received 210k USD. For UX audits, research, and improvements, 63k USD were spent. As a reward for preparing the Spammening that happened last December, Amforc received 45k USD. The Anti-Scam bounty paid out 39k USD.

Departments (Bounties & Collectives)

Departments, (sometimes also referred to as executive bodies) are set up to provide a service in a certain area of the ecosystem. They simplify OpenGov by bundling work in a certain area, reducing mental load and volume on the general voting tracks. Since 2024-Q3, executive bodies have processed ~19% of the total spending, in 2025-Q2 the ratio was 25%. Keep in mind that these costs were already represented in the previous chapters and this is just a different perspective to represent them.

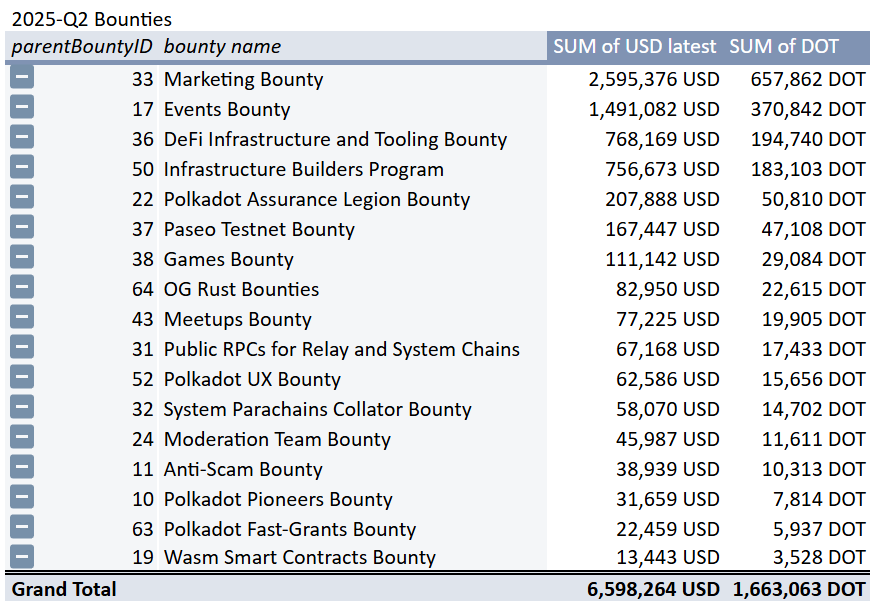

Bounties

Bounties are similar to departments in traditional organizations. Bounties have a specific mandate to spend money to achieve certain goals. Collectively, Bounties spent 6.6m USD, 24% of the total expenses in 2025-Q2. On top, we have the Marketing (2.6m USD) and Events (1.5m USD) bounties, focusing on outreach. DeFi Infrastructure and Tooling (770k USD) focuses onboarding of financial services to the Polkadot Hub. The Infrastructure Builders Program operates crucial node infrastructure, costing 760k USD. The Polkadot Assurance Legion provided security audits worth 210k USD. Paseo did cost 170k USD in the second quarter of 2025. The Games Bounty spent 110k USD.

Collectives

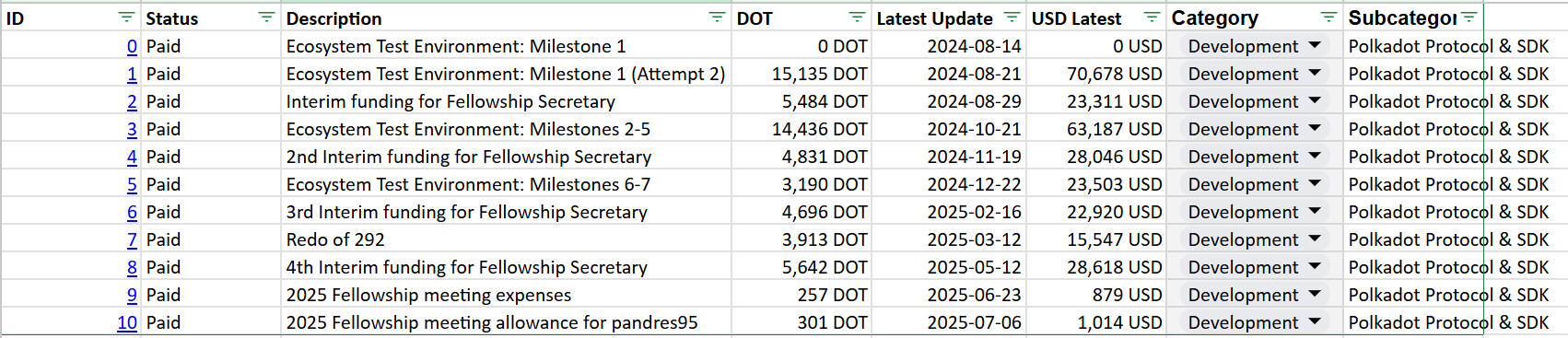

For the technical Fellowship, the following salary costs have accrued:

- 2025-04: 105k USD

- 2025-05: 107k USD

- 2025-06: 111k USD

In 2025-Q2, the Fellowship Subtreasury paid out two positions, resulting in 29k USD spending.

Analysis

Stablecoins

In this chapter, we want to look at the historic and projected stablecoin flows.

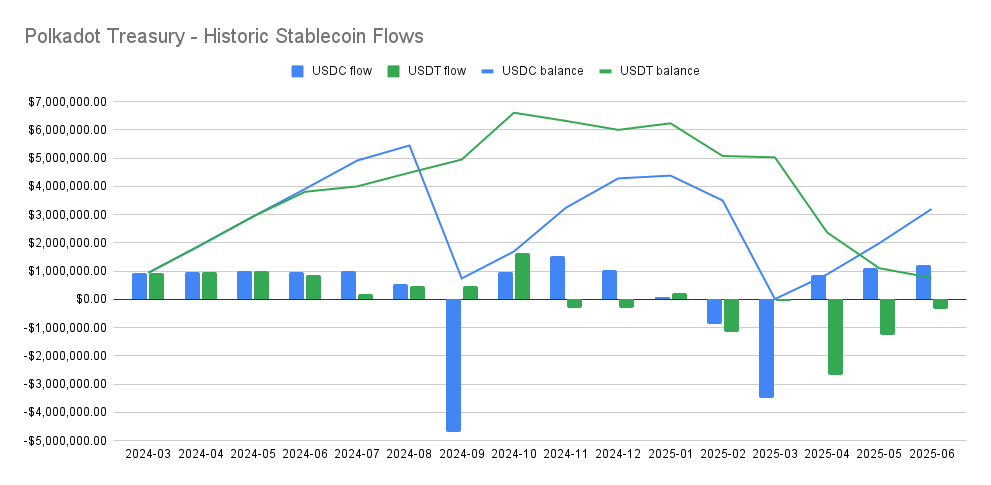

Historic Stablecoin Flows

In total, the Treasury has been accumulating 21m USDC and 21m USDT from 2024-03 until the end of 2025-Q2, an average rate of 2.5m USD in stables per month.

Spending has been keeping pace with inflows, with 18m USDC and 20m USDT going to proposers. 1.5m USD of idle USDC was also put into a liquidity loan towards Centrifuge.

Stablecoin acquisition campaign #3 has started in 2025-Q2 and will lead to an inflow of 2.8m USD in stables per month.

Below you see a breakdown of how much has been spent per quarter in DOT, USDC, and USDT, as well as the USD-equivalent of the whole quarter and the ratio of how many stables have been part of the spend per quarter.

Trend

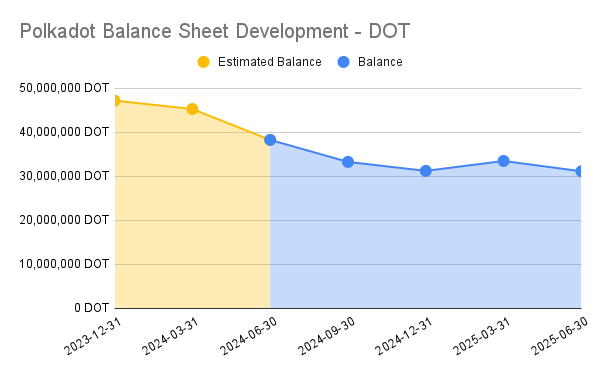

In the long-term trend, we can see that the DOT-denominated balance and cash are trending sideways. Since the Treasury is still very heavy on DOT, the overall Treasury value still correlates strongly with the DOT price.

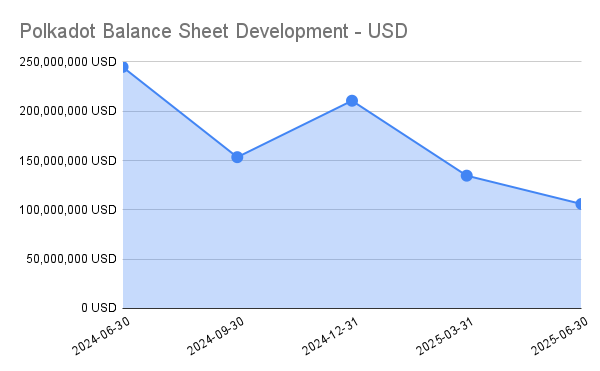

Balance Sheet Development

This quarter removed 2m DOT to the balance sheet, highlighting mostly stable spending. The Treasury correlation with the DOT price becomes visible in the USD chart:

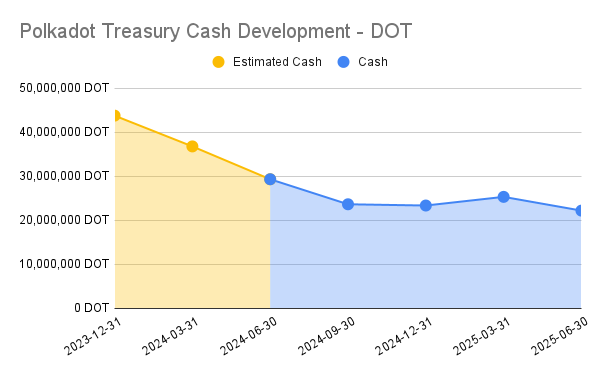

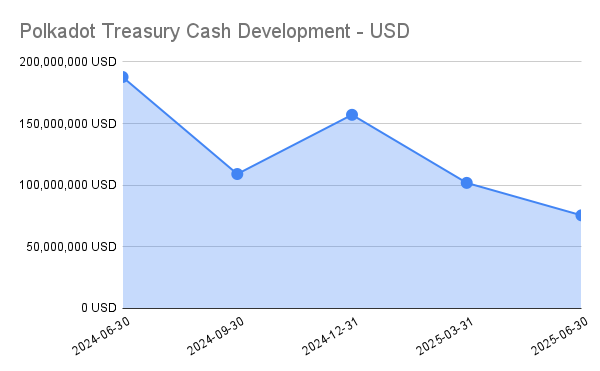

Treasury Cash Development

In terms of cash, we see a similar development as with the total balance, which indicates that the overall spending behavior stayed consistent with previous quarters.

Notes

- Code

- The raw data for this report can be found in the following places:

- For ease of readability we generally round to the two most significant digits.

- Data Acquisition Methodology

- We extend our thanks to the Subsquare, the Parity data team, and lolmcshizz for providing valuable data and inputs for this report.

- Balance sheet values

- intra-day exchange rates for DOT and MYTH were retrieved on 2025-06-30 from Coingecko

- token holdings on accounts were retrieved via Subscan

- The DOT amount in the Hydration Omnipool is retrieved from the Hydration UI

- Outstanding wages payable are retrieved from the SubSquare collectives UI

- Bounty holdings are retrieved from SubSquare

- Income Statement

- Referenda, Treasury Spends, Child Bounties, and Fellowship Subtreasury spends were fetched through Subsquare’s API

- Determination of DOT and USD values

- We do deep inspection of calls to build a bag of different assets.

- For a given date, the bags value in DOT or USD equivalent is then calculated according to market rates at those days

- Bounty and XCM send values are assumed 0. Typically they just move DOT into designated accounts and later spending can then be recognized independently

- batch calls are traversed

- Determination of DOT and USD values

- Full bounty spend: Two instances in the relevant timeframe is recorded. These were manually taken from Subscan

- Collective spend DOT values are approximated by taking the DOTUSD price in the middle of the period.

- Inflation, Burn, Fees, and other values have been provided on a monthly basis by the Parity data team.

- The Treasury got gifted several memecoins, which we currently do not consider sellable, thus valuing them 0.

- We use the following guiding principles to assign categories:

- Categories are assigned by where the primary effect of the spending will unfold its value. Titles and descriptions are less relevant here than the list of actual deliverables.

- We consider the perspective of the Polkadot ecosystem. Does it affect core technologies or is it application-specific?

- There are proposals that could belong to multiple categories. We choose the category where the majority of the costs go to.

- Referenda, Treasury Spends, Child Bounties, and Fellowship Subtreasury spends were fetched through Subsquare’s API

- The report uses cash accounting (for the most part)

- This means that expenses and income are considered when money changes accounts, not when the actual service is delivered.

- We strive to arrive at accrual accounting, as it is more in line with international accounting practices. But we lack the necessary team capacity and data from spends and bounties.

- This can create distortions, for example when payments are made that extend over the measurement period, or when transactions (like the Myth swap or the Inter Miami deal) are prepaid but not yet executed (and might still fail and get refunded). Another example is the new spend() extrinsic, which we account for at the time of referendum execution.

- The current report bases its numbers on the execution date of proposals, which can deviate from the time tokens are spent. For past reporting, we only represented direct spending from the Treasury and it was convenient to represent them on the date of spending.

- Expenses

- Loans and liquidity provisions are not represented in the income statement, as they do not count as expenses per accounting standards. They will show up on the balance sheet

- Bounty creation & bounty refills are also hidden since these are not yet expended but rather become designated assets. Once they are spent via child bounties (or in a single instance fully), expenses are accounted.

- Refunds: We record income from transfers to the Treasury. These transactions are most likely refunds from OpenGov proposers that have been overpaid or decided not to deliver. However, tracking the origin of these transactions is out of the scope of this report.

- issues

- we can’t track bounty spends if the bounty decides to liquidate to fiat to retain value. this leads to a spend being recorded at the time of liquidation

- similarly, the Marketing Bounty moved some funds to the Polkadot Community Foundation. They are not tracked after leaving the bounty main account and are counted as expenses. We will improve this in future reports.

- This report is created by humans and might contain errors. Don’t trust, verify.